Struggling with debt collectors? Learn how to navigate this tricky situation with our comprehensive guide on handling debt collectors efficiently and effectively. From understanding their tactics to protecting your rights, we’ve got you covered every step of the way.

Ready to take charge of your financial well-being? Let’s dive in and empower you with the knowledge you need to tackle debt collectors head-on.

Understanding Debt Collectors

Debt collectors play a crucial role in the process of collecting outstanding debts from individuals or businesses. They are hired by creditors or debt collection agencies to recover overdue payments on their behalf.

Role of Debt Collectors

- Debt collectors reach out to debtors through phone calls, letters, and emails to request payment.

- They negotiate payment plans and settlements with debtors to resolve the outstanding debt.

- If necessary, debt collectors may take legal action to collect the debt, such as filing a lawsuit or placing a lien on the debtor’s property.

Legal Rights and Limitations

- Debt collectors must abide by the Fair Debt Collection Practices Act (FDCPA), which prohibits practices like harassment, false statements, and unfair practices.

- They are not allowed to contact debtors at unreasonable hours, disclose the debt to third parties, or use deceptive tactics to collect the debt.

- Debt collectors must provide accurate information about the debt and the creditor when contacting debtors.

Common Tactics Used by Debt Collectors

- Constant phone calls and messages to pressure debtors into paying.

- Threatening legal action or consequences if the debt is not paid promptly.

- Offering settlement options to encourage debtors to make a partial payment to close the account.

Dealing with Debt Collectors

Dealing with debt collectors can be a stressful experience, but it’s important to handle it carefully to protect your rights and financial well-being. Here are some steps to follow when communicating with debt collectors:

Verify the Debt

Before making any payments or agreements with a debt collector, it’s crucial to verify that the debt is valid and that you owe the amount claimed. Request a written validation of the debt, including details like the original creditor, the amount owed, and any relevant account information.

- Check the accuracy of the debt information provided by the collector.

- Look out for any discrepancies or errors in the debt details.

- Ensure that the debt falls within the statute of limitations for collection in your state.

Negotiate a Payment Plan

If the debt is valid and you’re unable to pay the full amount at once, consider negotiating a payment plan with the debt collector. This can help you manage your payments effectively and avoid further financial stress.

Be prepared to offer a realistic payment amount based on your current financial situation.

- Communicate openly and honestly with the debt collector about your financial difficulties.

- Propose a payment plan that you can afford without compromising your basic needs.

- Get any agreements in writing to avoid misunderstandings in the future.

Legal Protection and Rights

Dealing with debt collectors can be stressful, but it’s important to know that there are laws in place to protect consumers from harassment and unfair practices. Understanding your rights can help you navigate these situations more effectively.

Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that Artikels what debt collectors can and cannot do when trying to collect a debt. Some key provisions of the FDCPA include:

- Debt collectors cannot contact you at unreasonable times or places, such as before 8 am or after 9 pm.

- They are not allowed to harass, oppress, or abuse you in any way, including using threats or obscene language.

- Debt collectors must identify themselves and provide information about the debt, including the amount owed and the name of the original creditor.

Statute of Limitations

The statute of limitations on debt collection refers to the amount of time that a creditor or debt collector has to sue you for an unpaid debt. This time frame varies by state and the type of debt. It’s important to know the statute of limitations in your state, as once the time limit has passed, the debt becomes “time-barred” and the creditor cannot sue you for payment.

Validation of Debt

If you receive a collection notice from a debt collector, you have the right to request validation of the debt. This means that the collector must provide proof that you owe the debt and that they have the legal right to collect it from you. You can send a written request for validation within 30 days of receiving the initial notice.

It’s crucial to keep records of all communication with debt collectors and to dispute any inaccuracies in the debt they claim you owe.

Impact on Credit Score

Dealing with debt collectors can have a significant impact on your credit score, as they can report your delinquent accounts to credit bureaus. This negative information can stay on your credit report for up to seven years, making it harder to qualify for loans, credit cards, or even secure housing in the future.

Minimizing Negative Impact

- Communicate with your creditor or debt collector to negotiate a payment plan or settlement that works for you.

- Request a pay-for-delete agreement where the debt collector agrees to remove the negative information from your credit report once you’ve paid off the debt.

- Monitor your credit report regularly to ensure that any inaccuracies or discrepancies are addressed promptly.

Rebuilding Credit

- Start by paying your bills on time and in full to establish a positive payment history.

- Consider applying for a secured credit card to build credit gradually.

- Keep your credit utilization low and avoid opening multiple new accounts at once.

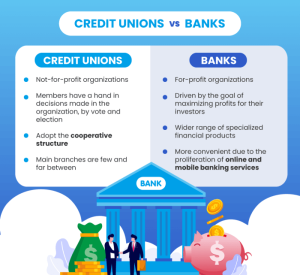

CREDIT AND COLLECTIONS BANKING SERVICES

Credit and collections play a crucial role in the banking sector, ensuring that financial institutions manage their lending activities effectively and recover any outstanding debts from borrowers. Effective credit management is essential for the stability and profitability of banks, as it helps minimize the risk of loan defaults and improve overall financial performance.

Role of Credit and Collections in Banking

- Credit departments assess the creditworthiness of borrowers and determine the terms and conditions of loans.

- Collections departments are responsible for following up on overdue payments and recovering outstanding debts from borrowers.

- Effective credit and collections practices help banks maintain a healthy loan portfolio and minimize losses.

Importance of Effective Credit Management

- Proper credit management helps banks identify and mitigate credit risks, ensuring the sustainability of their lending activities.

- By monitoring borrower behavior and financial performance, banks can make informed decisions regarding loan approvals and limits.

- Timely collections of outstanding debts improve cash flow and profitability for financial institutions.

Banking Services Related to Credit and Collections

- Debt consolidation loans: Banks offer consolidation loans to help individuals combine multiple debts into a single, more manageable repayment plan.

- Credit monitoring services: Banks provide credit monitoring tools to help customers track their credit scores and detect any suspicious activity.

- Collections agency partnerships: Financial institutions may collaborate with collections agencies to recover overdue debts on their behalf.

Closing Notes

In conclusion, dealing with debt collectors doesn’t have to be daunting. Armed with the right information and strategies, you can protect yourself and your finances. Remember, you have rights, and you can handle this!

Question Bank

Can debt collectors contact me at any time of the day?

Debt collectors are bound by the Fair Debt Collection Practices Act (FDCPA), which prohibits them from contacting you before 8 am or after 9 pm unless you agree to it.

Do I have to pay the full amount of debt collectors demand?

You have the right to negotiate with debt collectors. It’s often possible to settle for less than the total amount owed through a payment plan or lump sum settlement.

How long can debt collectors pursue me for a debt?

The statute of limitations on debt varies by state but typically ranges from 3 to 10 years. After this period, debt collectors can no longer sue you for the debt.

Will dealing with debt collectors affect my credit score?

Yes, debt collections can have a negative impact on your credit score. However, timely payments or negotiating a payment plan can help minimize the damage.