Embark on a journey into the world of Personal Savings Account Rates, where financial decisions meet opportunity in this captivating narrative filled with insights and guidance.

Discover the intricacies of different account types, factors influencing rates, and expert tips on selecting the right account for your financial goals.

Understanding Personal Savings Account Rates

Personal savings account rates refer to the interest rate offered by financial institutions on the money deposited in a savings account. This rate determines how much your savings will grow over time.

How Personal Savings Account Rates Work

When you deposit money into a savings account, the bank uses that money to lend to other customers in the form of loans or mortgages. The interest they earn from these loans is then passed on to you in the form of interest on your savings. This interest is usually calculated as an annual percentage yield (APY) and is added to your account on a regular basis.

Factors Affecting Personal Savings Account Rates

- The Federal Reserve’s monetary policy can impact interest rates across the banking industry, affecting the rates offered on savings accounts.

- The type of savings account you choose, such as a traditional savings account, high-yield savings account, or money market account, can also affect the interest rate.

- The amount of money you deposit and the frequency of deposits can influence the interest rate you receive on your savings.

- Economic conditions, inflation rates, and market trends can all play a role in determining personal savings account rates.

Importance of Comparing Different Rates

It is essential to compare the rates offered by different banks before choosing a personal savings account. By comparing rates, you can ensure that your savings are earning the highest possible interest, helping your money grow faster over time. Additionally, comparing rates can help you find the best account that suits your financial goals and needs.

Types of Personal Savings Accounts

When it comes to personal savings accounts, there are several options available to help individuals grow their savings. Here are some common types of personal savings accounts:

High-Yield Savings Accounts

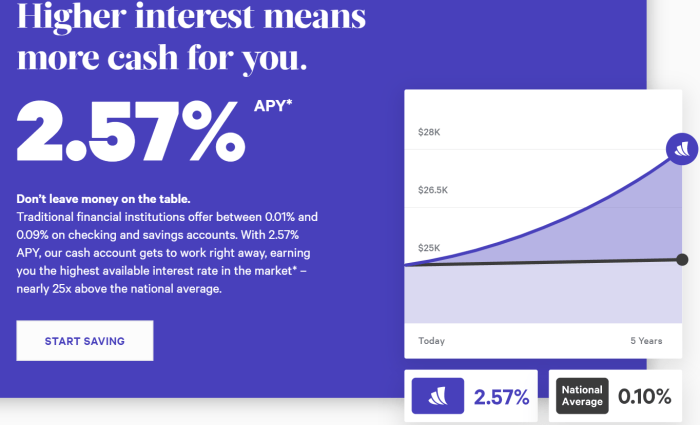

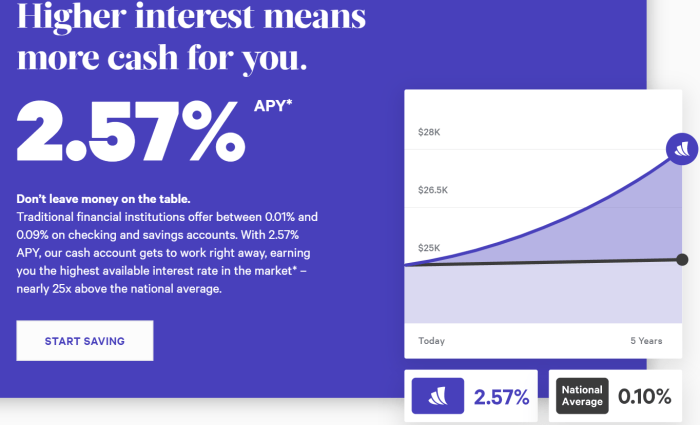

- High-yield savings accounts typically offer higher interest rates compared to regular savings accounts. This means your money can grow faster over time.

- These accounts are often online-based, which helps to reduce overhead costs for the bank, allowing them to offer better interest rates to customers.

- High-yield savings accounts are a great option for individuals looking to maximize the growth of their savings without taking on too much risk.

Regular Savings Accounts

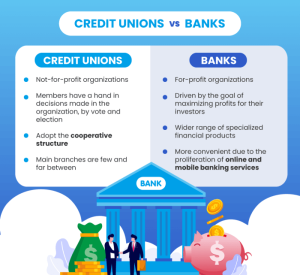

- Regular savings accounts are offered by traditional brick-and-mortar banks and credit unions.

- While these accounts may have lower interest rates compared to high-yield savings accounts, they often come with added benefits such as in-person customer service and easy access to funds.

- Regular savings accounts are a good choice for individuals who prefer the convenience of having a physical branch location.

Fixed-Rate Personal Savings Accounts

- Fixed-rate personal savings accounts offer a guaranteed interest rate for a specific period of time.

- These accounts provide stability and predictability when it comes to the interest earned on your savings.

- Fixed-rate accounts are ideal for individuals who want to lock in a certain interest rate and are comfortable with not being able to take advantage of potential interest rate increases during the term.

Variable-Rate Personal Savings Accounts

- Variable-rate personal savings accounts have interest rates that can fluctuate based on market conditions.

- These accounts allow you to potentially benefit from interest rate increases, but they also come with the risk of earning less if interest rates go down.

- Variable-rate accounts are suitable for individuals who are willing to take on a bit more risk in exchange for the possibility of higher returns.

Factors Influencing Personal Savings Account Rates

When it comes to personal savings account rates, there are several key factors that can influence the interest you earn on your savings. Understanding these factors can help you make informed decisions about where to put your money.

Economic Indicators Impacting Personal Savings Account Rates

- The unemployment rate: When the economy is strong and unemployment is low, banks may offer higher interest rates on savings accounts to attract more deposits.

- GDP growth: Positive economic growth can lead to higher savings rates as banks have more funds available to lend out at higher rates.

- Stock market performance: Banks may adjust savings rates based on stock market trends to stay competitive and attract deposits.

Inflation Rates and Savings Account Rates

- When inflation rates are high, the purchasing power of money decreases over time. To combat this, banks may raise interest rates on savings accounts to help offset the effects of inflation.

- It’s important to choose a savings account with an interest rate that outpaces inflation to ensure that your money maintains its value over time.

Impact of Federal Reserve’s Monetary Policy

- The Federal Reserve’s monetary policy plays a significant role in determining interest rates across the economy, including savings account rates.

- When the Federal Reserve raises or lowers the federal funds rate, banks may adjust the interest rates on savings accounts accordingly.

- Changes in the Federal Reserve’s monetary policy can have a direct impact on the rates you earn on your savings, so it’s important to stay informed about these decisions.

Choosing the Right Personal Savings Account

When it comes to selecting the best personal savings account for your financial goals, there are a few key factors to consider. Understanding these factors can help you make an informed decision that aligns with your saving objectives.

Reading the Fine Print and Understanding Fees

Before opening a personal savings account, it is crucial to carefully read the terms and conditions, including the fine print. Pay close attention to any fees associated with the account, such as monthly maintenance fees, overdraft fees, or minimum balance requirements. Understanding these fees can help you avoid unexpected charges and select an account that suits your financial situation.

Maximizing Savings through the Right Account Choice

One strategy for maximizing your savings is to choose an account with a competitive interest rate. Look for accounts that offer high annual percentage yields (APY) to ensure your savings grow over time. Additionally, consider accounts with features like automatic transfers or round-up options to help you save more consistently.

CREDIT AND COLLECTIONS BANKING SERVICES

Credit and collections are crucial aspects of banking services that deal with managing the extension of credit to customers and the recovery of funds owed to the bank. These services play a vital role in maintaining the financial health of a bank and ensuring the smooth functioning of its operations.

Role of Credit and Collections

Credit and collections in banking services involve assessing the creditworthiness of customers, determining their ability to repay borrowed funds, and managing the collection of outstanding debts. Banks rely on these services to make informed decisions about extending credit, setting interest rates, and recovering unpaid balances.

- Credit Evaluation: Banks conduct thorough evaluations of customers’ credit histories, financial statements, and repayment capacity to assess the risk associated with lending money. This process helps banks make sound lending decisions and minimize the likelihood of defaults.

- Collections Management: Banks use various strategies and tools to collect overdue payments from customers, such as sending reminders, imposing penalties, and working with collection agencies. Effective collections management is essential for recovering funds and reducing financial losses.

Importance of Credit Evaluation

Credit evaluation is a critical component of banking operations as it enables banks to mitigate risks, protect their assets, and maintain a healthy loan portfolio. By thoroughly assessing customers’ creditworthiness, banks can make informed decisions about lending money, setting interest rates, and establishing repayment terms.

- Risk Mitigation: Proper credit evaluation helps banks identify high-risk borrowers and take appropriate measures to minimize the likelihood of defaults. This proactive approach safeguards the bank’s financial stability and reduces the impact of non-performing loans.

- Asset Protection: Through effective credit evaluation, banks can protect their assets by avoiding lending to individuals or businesses with a high probability of default. This safeguards the bank’s capital and ensures the sustainability of its operations.

Common Banking Services Related to Credit and Collections

Banks offer a range of services related to credit and collections to meet the diverse needs of their customers and manage their financial transactions effectively. These services are designed to facilitate borrowing, repayment, and debt recovery processes in a secure and efficient manner.

- Loan Products: Banks provide various loan products, such as personal loans, mortgages, and business loans, to meet the financing requirements of individuals and businesses. These products are tailored to suit different purposes and repayment capacities.

- Debt Collection Services: Banks offer debt collection services to assist customers in recovering outstanding debts and managing delinquent accounts. These services help customers navigate the debt recovery process and negotiate repayment terms.

Final Thoughts

As we conclude this enlightening discussion on Personal Savings Account Rates, remember to compare, evaluate, and choose wisely to make the most of your savings potential.

FAQ Compilation

What factors can affect personal savings account rates?

Factors such as economic indicators, inflation rates, and the Federal Reserve’s monetary policy can influence personal savings account rates.

What are the common types of personal savings accounts available?

Common types include high-yield savings accounts, regular savings accounts, fixed-rate, and variable-rate personal savings accounts.

How can I maximize savings through the right account choice?

To maximize savings, choose an account that aligns with your financial goals, read the fine print, and understand associated fees for each account.